It has 500,000 subscription customers and will boost sales with these funds. Backblaze has two exabytes under storage. Backblaze went public for several reasons, opening up the company books to clients while proving its maturity with a technology play for the long haul. He added that the company has efficiently developed its reach and operations over the years. Backblaze shares climbed 24 in their debut on Thursday and another 12 on Friday, lifting the price to 22. According to the company’s CEO & co-founder, Gleb Budman, investors were always eager for a company approaching a public listing while having raised a tiny sum of money to date.

The company began in 2007 and issued $10 million sometime earlier through convertible notes. Harland & Wolff Group 11.3p 18.3m (HARL.

#Cloud backblaze thursday friday 100m ipo update#

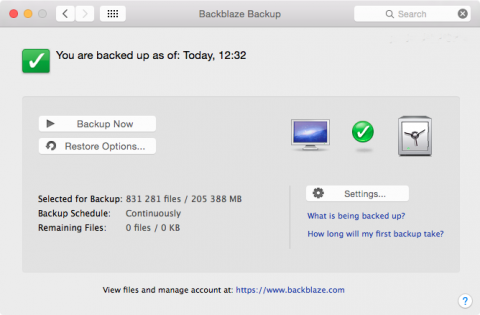

Twenty-one companies debuting in 2021 have valuations exceeding $10 billion.īackblaze got $3 million in funding from external investors along its journey. CLOUD BACKBLAZE THURSDAY 100M IPO UPDATE The company focused on strategic infrastructure projects and physical asset lifecycle management, provides a trading update for the year ended 31 December 2022 (FY22) and aspirations for FY23/FY24. 11, Backblaze ( BLZE 0.48) has already seen its stock price surge by more than 100, and is currently trading around 31 a share. 100+ tech companies have already gone public in the USA. Since its initial public offering (IPO) at 16 per share on Nov. Backblaze has a market cap of $650 million in the micro-cap segment. Storage cloud platform, Backblaze (NASDAQ: BLZE) has priced its initial public offering of 6.25M shares of its Class A common stock at 16.00 per share, for gross proceeds to Backblaze of 100M. They also increased by 12% again, taking the share price to $22.31. The company got $100 million in funding, with its shares rising by 24% afterward. They were $16.2 million for the period, according to reports. (Backblaze), a leading storage cloud platform, announced the pricing of its initial. The company revenues were $59.9 million for the year, concluding on 30th June, with Q2 sales figures increasing by 17%. Techmeme: Cloud backup service Backblaze climbed 24 in its Nasdaq debut on Thursday and 12 on Friday, after raising 100M in its IPO, giving it a market cap of 650M (Jordan Novet/CNBC) The essential tech news of the moment. SAN MATEO, Calif.- ( BUSINESS WIRE )-Backblaze, Inc. At the other end of the spectrum, Backblaze made news with another IPO. The market cap went past $105 billion for Rivian Automotive afterward, putting it ahead of General Motors and Ford. Yet, the company made headlines, raising almost $12 billion with an IPO. Rivian Automotive, a leading electric vehicle manufacturer, currently has negligible revenues.

0 kommentar(er)

0 kommentar(er)